Recognizing the Process Behind an Online Tax Return in Australia and How It Works

Recognizing the Process Behind an Online Tax Return in Australia and How It Works

Blog Article

Simplify Your Funds: Exactly How to File Your Online Tax Return in Australia

Declaring your on-line tax obligation return in Australia need not be a difficult job if come close to systematically. Comprehending the details of the tax system and adequately preparing your files are important very first steps. Picking a reliable online platform can enhance the procedure, but many neglect important information that can impact their general experience. This discussion will check out the needed components and approaches for simplifying your funds, eventually leading to a more efficient declaring procedure. What are the common pitfalls to avoid, and exactly how can you make sure that your return is certified and precise?

Understanding the Tax Obligation System

To navigate the Australian tax system effectively, it is necessary to grasp its basic principles and framework. The Australian tax system operates a self-assessment basis, suggesting taxpayers are accountable for precisely reporting their earnings and determining their tax obligation obligations. The primary tax obligation authority, the Australian Tax Workplace (ATO), supervises conformity and applies tax legislations.

The tax system comprises various elements, including revenue tax obligation, solutions and goods tax (GST), and capital gains tax obligation (CGT), among others. Specific earnings tax is modern, with prices raising as earnings rises, while business tax prices differ for big and tiny companies. Additionally, tax offsets and reductions are available to minimize taxed revenue, permitting more customized tax obligation liabilities based on individual conditions.

Knowledge tax obligation residency is additionally critical, as it figures out an individual's tax obligations. Homeowners are exhausted on their globally income, while non-residents are only strained on Australian-sourced income. Knowledge with these concepts will empower taxpayers to make informed choices, making certain compliance and possibly maximizing their tax obligation results as they prepare to file their on the internet income tax return.

Preparing Your Files

Gathering the necessary papers is an essential action in preparing to submit your on the internet income tax return in Australia. Appropriate paperwork not only streamlines the filing procedure but additionally makes certain accuracy, decreasing the danger of errors that might cause fines or hold-ups.

Start by accumulating your earnings statements, such as your PAYG settlement recaps from employers, which detail your incomes and tax obligation kept. online tax return in Australia. If you are self-employed, ensure you have your company earnings records and any type of appropriate billings. Furthermore, gather financial institution statements and paperwork for any kind of passion made

Following, compile records of insurance deductible costs. This may consist of receipts for occupational expenses, such as attires, travel, and tools, as well as any kind of instructional expenditures associated with your profession. Guarantee you have paperwork for rental revenue and associated costs like fixings or home administration fees. if you own property.

Don't forget to include other appropriate papers, such as your medical insurance information, superannuation contributions, and any kind of financial investment earnings declarations. By diligently arranging these documents, you set a strong foundation for a reliable and smooth online income tax return process.

Selecting an Online Platform

After organizing your documentation, the following step involves selecting an appropriate online platform for submitting your income tax return. online tax return in Australia. In Australia, a number of reliable platforms are readily available, each offering special functions tailored to various taxpayer requirements

When picking an on the internet system, think about the user interface and convenience of navigating. A straightforward design can significantly improve your experience, making it less complicated to input your info precisely. Furthermore, make certain the system is certified with the Australian Taxation Workplace (ATO) policies, as this will certainly assure that your entry fulfills all legal needs.

Systems offering online talk, phone support, or extensive Frequently asked right here questions can supply beneficial assistance if you experience obstacles throughout the declaring process. Look for platforms that use security and have a strong personal privacy this policy.

Lastly, take into consideration the expenses connected with various platforms. While some might offer cost-free solutions for fundamental tax returns, others might bill fees for advanced features or added assistance. Consider these elements to select the platform that lines up best with your monetary scenario and declaring requirements.

Step-by-Step Declaring Process

The step-by-step filing procedure for your online tax return in Australia is created to streamline the entry of your monetary details while making certain compliance with ATO guidelines. Begin by collecting all essential documents, including your earnings declarations, financial institution statements, and any type of receipts for deductions.

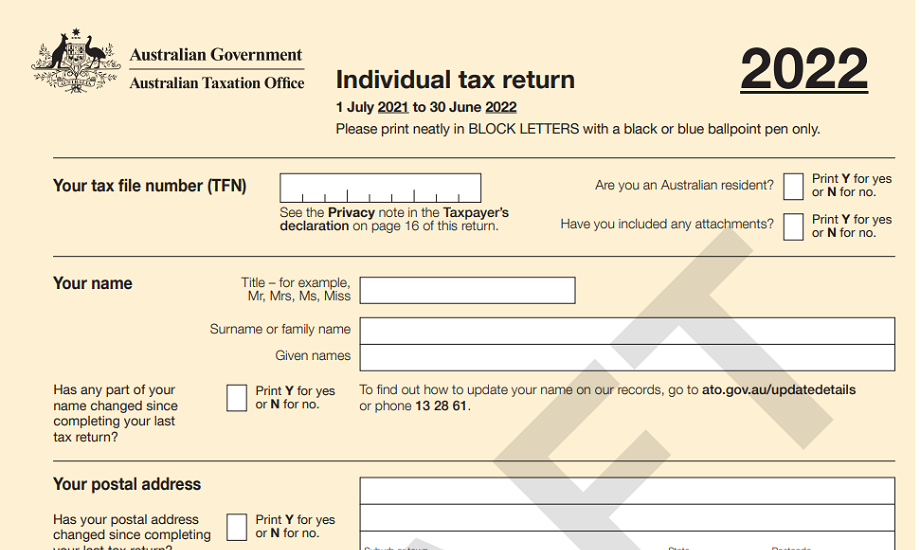

When you have your records prepared, visit to your chosen online system and create or access your account. Input your individual information, including your Tax obligation Data Number (TFN) and get in touch with information. Following, enter your income information properly, making sure to include all incomes such as wages, rental earnings, or investment profits.

After describing your income, go on to assert eligible reductions. This may include occupational expenses, philanthropic donations, and clinical expenses. Be sure to assess the ATO guidelines to optimize your claims.

When all details is entered, meticulously assess your return for accuracy, correcting any type of inconsistencies. After making sure everything is right, submit your income tax return digitally. You will certainly get a verification of entry; maintain this for your records. Last but not least, monitor your make up any kind of updates from the ATO regarding your tax obligation return condition.

Tips for a Smooth Experience

Completing your on-line tax return can be a simple procedure with the right preparation and attitude. To ensure a smooth experience, begin by gathering all needed papers, such as your income declarations, invoices for deductions, and any type of various other pertinent monetary records. This company lessens errors and conserves time during the filing procedure.

Next, familiarize on your own with the Australian Taxes Workplace (ATO) internet site and its on the internet services. Use the ATO's sources, including guides and FAQs, to make clear any unpredictabilities before you begin. online tax return in Australia. Think about establishing up a MyGov account connected to the ATO for a streamlined declaring experience

Additionally, capitalize on the pre-fill performance offered by the ATO, which instantly populates a few of your details, decreasing the opportunity of mistakes. Ensure you verify all entrances for precision before submission.

If complications emerge, don't hesitate to consult a tax obligation professional or use the ATO's support services. you can find out more Complying with these suggestions can lead to a hassle-free and successful online tax obligation return experience.

Final Thought

In final thought, filing an online tax obligation return in Australia can be structured through careful prep work and selection of suitable sources. Ultimately, these methods add to a more reliable tax obligation declaring experience, streamlining monetary management and enhancing compliance with tax obligations.

Report this page